How the GCC Is Rewriting the rulebook for Emerging Markets

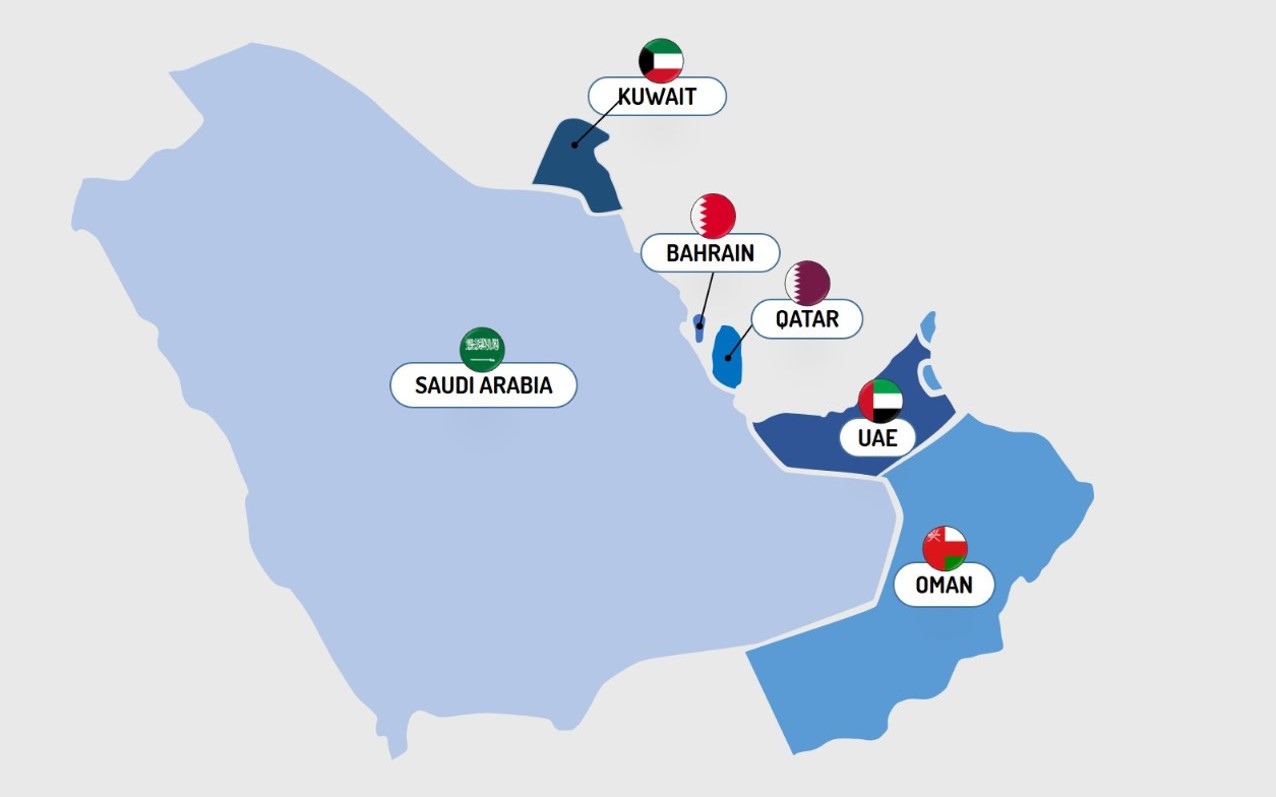

The six-nation Gulf Cooperation Council (GCC) is undergoing a transformative shift in its capital markets, positioning itself as a formidable player among emerging markets. Through strategic reforms, rising foreign investment, standard regulatory provisions and a commitment to economic diversification, the GCC as a bloc is actively reshaping its financial landscape.

As of the end of 2024, the combined market capitalization of GCC stock exchanges reached $4.2 trillion, a fourfold increase over the past decade. This growth reflects the impact of wide-ranging economic reforms and sustained investor confidence. Foreign equity inflows into GCC markets doubled to $60 billion by the end of 2024, driven by regulatory liberalization and the inclusion of regional exchanges in global indices such as the MSCI Emerging Markets Index.

On the other hand, Saudi Arabia’s Tadawul Exchange continues to lead the region, accounting for 62% of total GCC market capitalization. With a market value of $2.7 trillion, Tadawul has cemented its status as the largest stock exchange in the Arab world and among the top 10 globally. The GCC has also witnessed a surge in initial public offerings (IPOs), particularly in Saudi Arabia. In the first half of 2024, Tadawul’s Main Market IPO volumes doubled compared to the same period in 2023.

This momentum underscores the region’s commitment to privatization, capital market development, and private sector growth in line with long-term national visions like Saudi Vision 2030. Across the GCC, regulatory frameworks are evolving. Key reforms include the establishment of IPO funds, expanded foreign ownership limits, and more structured disclosure regimes. These reforms are increasing international participation and confidence in the region’s equity markets.

As the GCC continues to modernize its capital markets, it is not just catching up with global standards — it is setting new ones. By embracing transparency, liberalization, and strategic public offerings, the region is becoming a more attractive destination for global capital. With its scale, ambition, and reform momentum, the GCC is not just participating in the future of emerging markets — it is helping to define it.

To this end, it is important to note that the GCC countries contributed over 35 percent of all emerging-market (EM) U.S. dollar debt issued in Q1 2025 (excluding China), up from around 25 percent in 2024, a new report revealed. According to Fitch Ratings, this upward trend is likely to continue growing during 2025–2026, according to Fitch Ratings.

The expansion of GCC debt capital markets (DCMs) is anticipated, driven by factors such as funding diversification, project financing, budget deficits, maturities, and regulatory changes. However, the region remains vulnerable to global macroeconomic and financial market uncertainty. The GCC DCM continues to display fragmentation among its six member countries regarding maturity, depth, and credit profile, with Saudi Arabia and the UAE being the most developed.