MAGNiTT: Saudi Arabia Leads the Region with Record $1.72 Billion in Venture Capital Driven by Fintech, Gaming

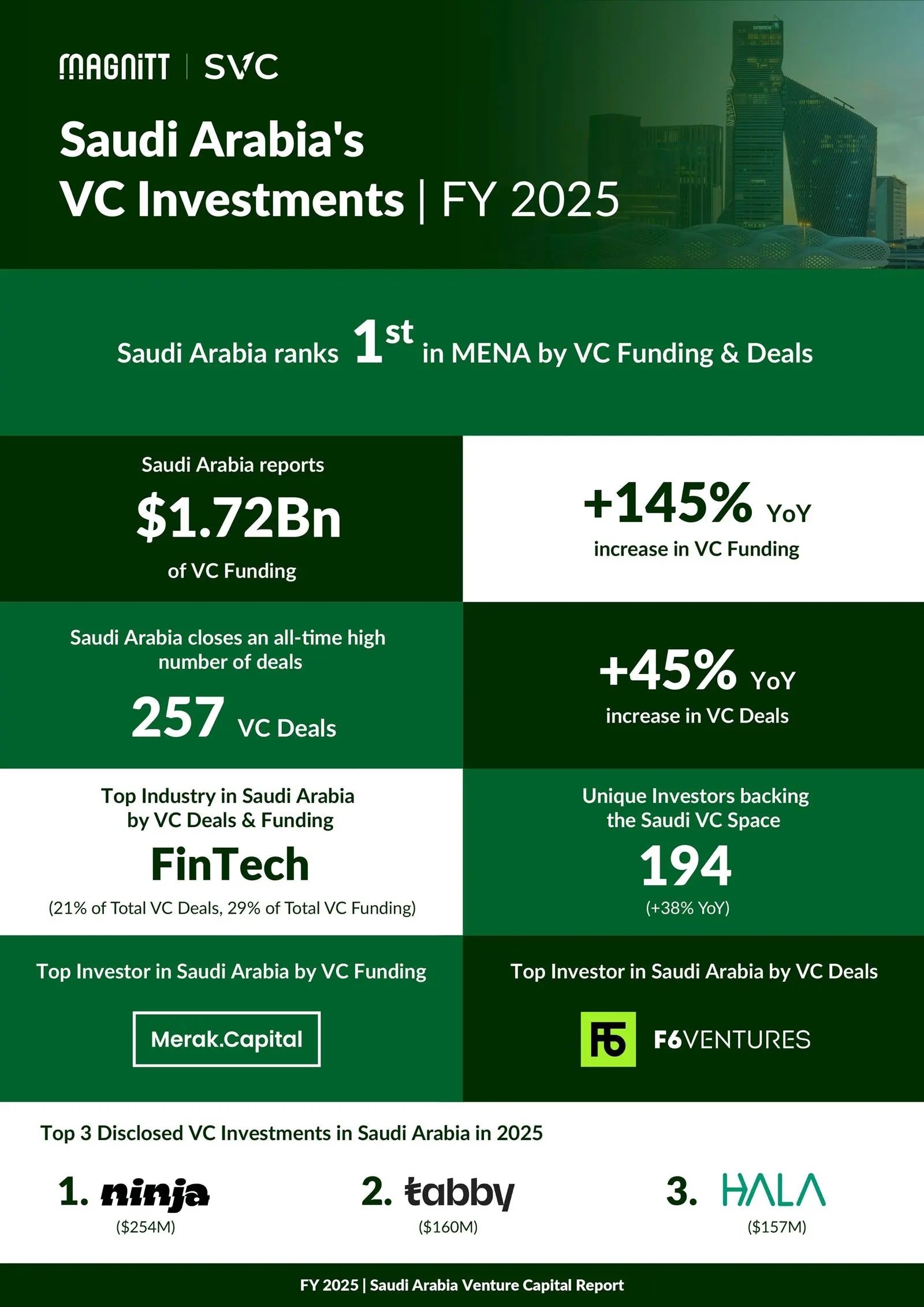

A report released by MAGNiTT, the leading venture capital data platform covering the Middle East and North Africa (MENA), confirmed that the Kingdom of Saudi Arabia maintained its first rank in the region for venture capital investment in 2025 for the third consecutive year, recording historic highs in both total investment value and number of deals.

According to the report, total venture capital investment in Saudi Arabia reached $1.72 billion in 2025, while the number of deals rose to 257 transactions, the highest level ever recorded. This performance reflects the rapid growth of the Saudi venture capital market and further cements the Kingdom’s position as the largest VC market in the region.

Commenting on the results, Saudi Venture Capital Company (SVC) Deputy CEO and Chief Investment Officer Nora Alsarhan stated that these outcomes reflect the rising maturity of the Kingdom’s venture capital ecosystem and the success of sustained efforts over recent years to build an attractive investment environment. She noted that this progress has been supported by regulatory enhancements, coherent government policies, and the growing role of the private sector.

Alsarhan added: “This year’s indicators point to a qualitative shift in the nature of venture capital deals in terms of size, sectoral diversity, and the readiness of the Saudi startups. This further strengthens venture capital’s role as a key driver of economic growth and supports the development of national companies capable of scaling and competing regionally and globally.”

The report highlighted that this performance represents a significant increase compared to 2024, when venture capital investment totaled approximately $700 million, resulting in a growth rate exceeding 145% in a single year. This sharp rise underscores growing investor confidence in the Saudi market and its capacity to absorb larger and more diversified investments.

At the sector level, financial technology (Fintech) emerged as the most attractive sector, attracting more than $506 million across 55 deals, reflecting the expanding role of technology in advancing the financial sector and enhancing its efficiency.

Among the notable transactions cited in the report were investments in companies such as Ninja, Tabby, and Hala, while the gaming sector also recorded significant momentum, with the online game “Kammelna” marking the largest gaming deal in the Saudi market.

This strong performance coincides with the Kingdom entering its tenth year of Saudi Vision 2030, which has laid the foundation for a diversified, globally competitive economy. Venture capital has become one of the most prominent indicators of this transformation, demonstrating Saudi Arabia’s transition into a new phase of innovation-driven and private-sector-led growth.