Asset Management vs. Wealth Management: Understanding the Key Differences and Their Impact

In the world of finance, the terms "asset management" and "wealth management" are often used interchangeably, but they represent distinct services with different scopes, clients, and strategies. While both fields focus on financial growth and the management of assets, the approaches and the needs they address are not the same. It is crucial to help the stakeholders understand these differences, as they can greatly impact both the services provided and the financial goals achieved. Here, we break down these two financial services to clarify the pivotal distinctions and why it matters.

Asset Management: A Focus on Investments

Asset management refers to the professional management of investments on behalf of clients, with a strong emphasis on maximizing returns and managing risks. Typically, asset managers oversee portfolios consisting of a wide range of investment vehicles such as stocks, bonds, real estate, and other assets.

Asset management is primarily centered around investment strategy development, portfolio management, and risk management. Asset managers are responsible for aligning a portfolio with a client’s risk profile and return objectives, which is especially important for institutional clients such as pension funds, sovereign wealth funds, and large corporations. These clients seek specialized expertise in creating and managing investments that can generate consistent returns over time while also controlling potential risks.

Example in the Middle East

A key example of asset management in the region is the Abu Dhabi Investment Authority (ADIA). ADIA is one of the world’s largest sovereign wealth funds and manages a diversified portfolio of global investments. With a focus on maximizing returns and managing risk, ADIA uses its deep expertise to invest across a wide range of asset classes, including equities, fixed income, real estate, and private equity, all aligned with the long-term financial goals of the Emirate of Abu Dhabi.

Who Needs Asset Management?

Clients that require asset management are typically institutional investors—including pension funds, endowments, sovereign wealth funds, and large corporations. However, it is also an option for individual investors who prefer a more hands-off approach to managing their investment portfolios.

Wealth Management: A Holistic Financial Approach

On the other hand, wealth management is a broader service that not only includes asset management but also goes further by encompassing comprehensive financial planning, estate planning, tax strategy, retirement planning, and other services specifically designed for high-net-worth individuals (HNWIs) and families. Wealth management is a more personalized service, focusing on the long-term financial health of the client and offering advice and guidance on a variety of financial matters beyond investment management.

In addition to managing investments, wealth management aims to help clients preserve and grow their wealth over multiple generations. Wealth managers integrate estate and tax planning to ensure that wealth is effectively passed down to heirs, along with advice on philanthropy and retirement planning to ensure clients’ legacies are preserved.

Example in the Middle East

A prominent example of wealth management in the region is SAB Wealth Management in the Kingdom of Saudi Arabia (KSA). This division serves high-net-worth clients by offering a full suite of services that include investment management, financial planning, estate planning, and more. For these clients, the focus is on building and preserving wealth across various aspects of their financial lives.

Who Needs Wealth Management?

Wealth management typically serves high-net-worth individuals (HNWIs) and families who need a wide range of financial services tailored to their specific needs. These individuals seek not only to manage their investments but also to create a comprehensive, integrated financial strategy that spans multiple generations and addresses personal, family, and business-related financial needs.

Key Differences

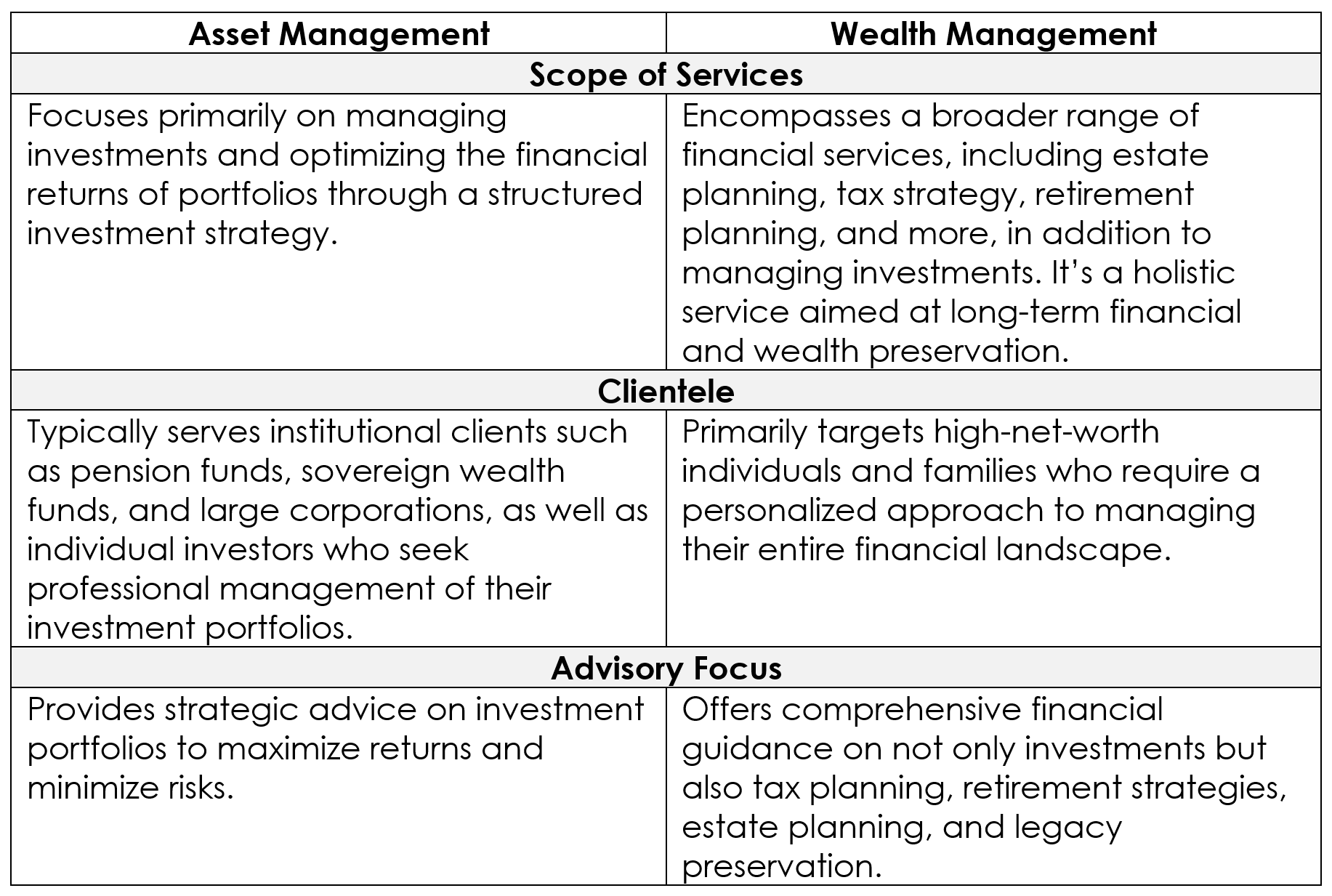

While both asset management and wealth management aim to grow and protect wealth, they are not interchangeable. Here are the key distinctions:

Why Understanding the Difference Matters

The confusion between asset management and wealth management is understandable, given that both fields involve managing money and investing for growth. However, the underlying differences are important because they shape the types of services clients receive and the outcomes they can expect.

As a consultant, it is essential to educate clients, stakeholders, and the public on these distinctions to ensure they make informed decisions about their financial management needs. Whether it’s an institutional client seeking strategic investment advice or a high-net-worth individual seeking to protect their wealth for future generations, understanding the right service to use can have a profound impact on achieving financial goals.

Furthermore, by clearly distinguishing between asset and wealth management, financial institutions can tailor their messaging, marketing, and client outreach to attract the right clientele, providing a more personalized experience and positioning themselves as experts in their respective fields.

Asset management and wealth management are both integral parts of the financial services ecosystem, but they serve different client needs and offer distinct services. Asset management is focused on optimizing investment portfolios, while wealth management provides a more comprehensive, holistic approach to managing an individual or family’s entire financial life. Understanding these differences is crucial for both clients and financial professionals alike, ensuring that the right services are chosen to meet specific financial goals and secure a prosperous future.